My Fellow Grandeur Peak Investors,

When we started Grandeur Peak 13 years ago, we made a commitment to try and treat every one of our investors as if they were a personal friend. In fact, I have a lot a lot of life-long, very close friends who invest with Grandeur Peak. In addition, my own children and extended family are shareholders. As a result, I feel that it is important for me and the rest of the Grandeur Peak team not to lose sight of why we come to work every day. We understand that you are counting on us to be stewards of your investment capital. We know that you have very important plans with the money you have invested, and we do not take lightly the trust that you have extended to us.

Over the last three years, Grandeur Peak portfolios, apart from our Global Contrarian Fund, have realized poor performance in both absolute terms and relative to our benchmarks and peers. We are very disappointed and frustrated with the results, as I’m sure you are. I’ve been investing in global small cap markets for well over two decades now. I’ve seen incredible market rallies and the sharpest of selloffs. I’ve had great years that left me feeling invincible and other years that have brought me to my knees. But the last three years have been a new low for me and for Grandeur Peak. Given our “personal friend” mentality, I feel like I owe you a detailed explanation on our underperformance. No excuses, no analogies, just straight talk.

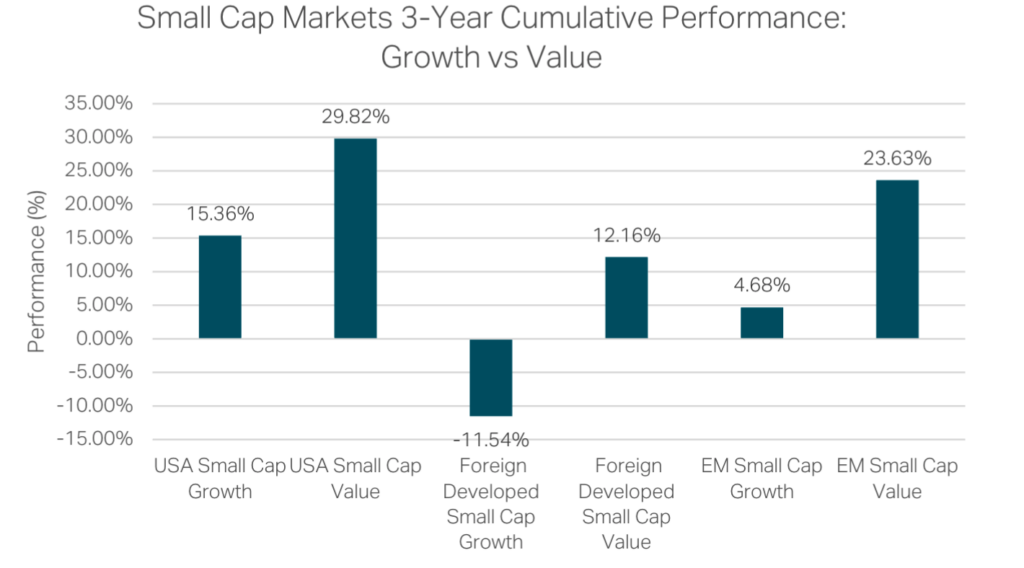

As we have discussed at length in recent shareholder communication, much of our recent poor performance is the product of our investment style. We have been investing in out-of-favor segments of the market. Small cap growth stocks, especially in foreign markets, have meaningfully underperformed the last three years (See Exhibit 1). Unfortunately, our high-quality bias has not helped either as many low-quality value stocks have experienced strong performance this year. In many cases, the stocks that have done well in 2024 are stocks that we have deemed uninvestable for our strategies. They are stocks with extremely poor fundamentals, where we feel we would be putting your capital at risk by investing in them.

Exhibit 1

Source: Factset, MSCI Index returns, as of Nov 30, 20241

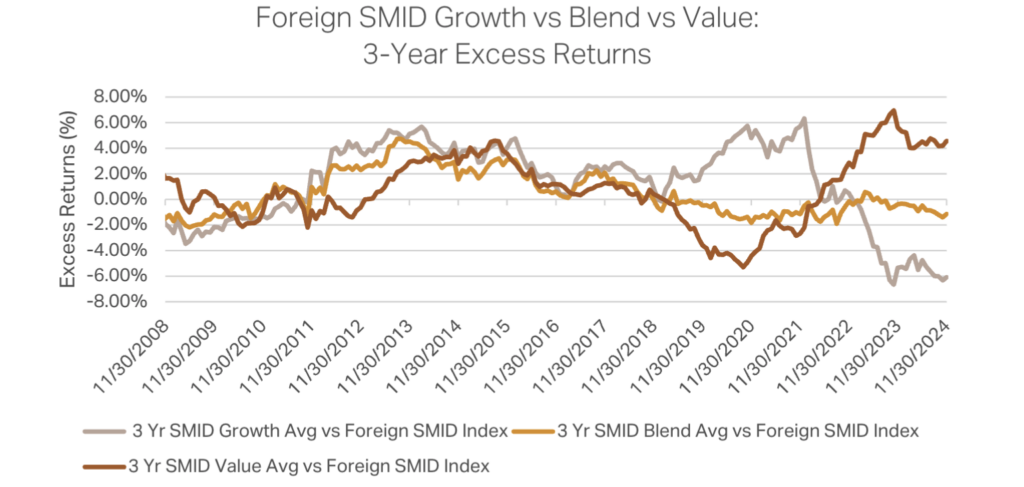

The extreme outperformance of small cap value stocks has been so pronounced in foreign and small cap markets that almost all small- and mid-cap global and foreign investment managers with a growth-orientation have underperformed meaningfully over the past three years. Exhibit 2 compares the excess return of Foreign SMID Index against the category returns for foreign managers based on their Morningstar style box classification (i.e., growth, blend or value).

Exhibit 2

Source: Morningstar Direct, as of Nov 30 20242

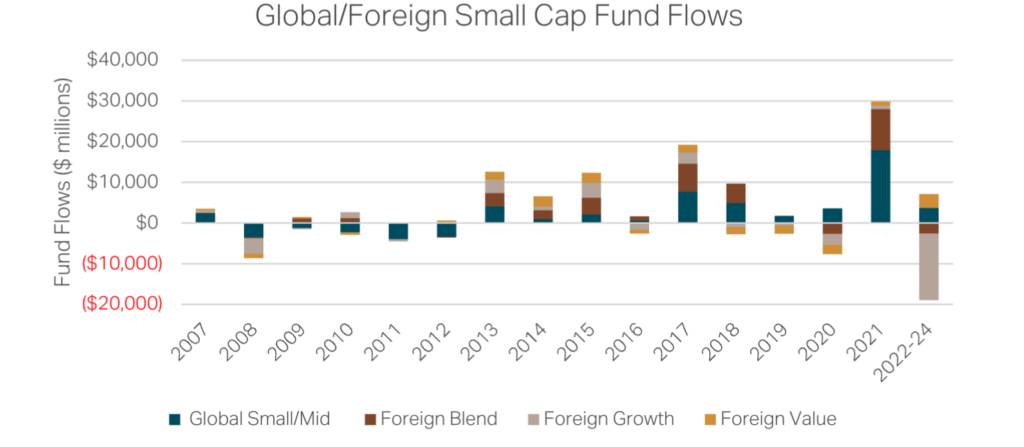

Also, the lack of appetite for global small cap stocks, especially the foreign small cap growth variety, has been another major headwind. Global small/mid cap market outflows over the past three years have far exceeded the level of outflows that occurred during the 2007-09 Global Financial Crisis. Furthermore, the outflows have been concentrated in foreign small cap growth strategies (See Exhibit 3) It’s hard for stock prices to align with underlying fundamentals, like earnings growth, in the short run when investors are pulling money out of the market indiscriminately.

Exhibit 3

Source: Morningstar Direct, as of Oct 31, 2024

Putting those factors aside, we have also made several mistakes. Making mistakes in global small cap investing is par for the course. It is a very, very inefficient market and those inefficiencies produce a great opportunity for disciplined, fundamental investors to generate attractive long-term investment returns. However, there can be a lot of pitfalls that come with investing in small cap markets, and even the most experienced investors are bound to fall into some. Investment success or failure hinges on how good you are at avoiding the major pitfalls. Unfortunately, current macro-economic and regulatory conditions have increased the number and severity of the pitfalls and we have fallen in too many of them over the past three years.

There are three main types of mistakes that can be made investing in equity markets. First, you can get your stock selection wrong (i.e., you buy the wrong stocks). Given our high-quality style bias, a selection mistake basically means we got our quality assessment wrong. This is the worst mistake of all and the one we work hardest to avoid. Second, you can own the wrong weight of a stock in the portfolio when the company’s business momentum changes, causing a significant price movement in either direction. You either own too much of it when it is going down or not enough when it is going up. Third, you can overpay for a stock. Yes, it may be high in quality, but if you buy it when it is overvalued and the price corrects, you can still lose money. Our quality, value and momentum (QVM) investment framework aims to mitigate all three types of mistakes.

As I look back at our missteps over the past three years, most have been related to valuation and weighting, but we have made some selection mistakes as well.

There have been several cases where we either overestimated the sustainability of a company’s competitive advantage or the quality of a management team. You can invest in a company that has a great business plan with significant headroom to grow, but if they can’t sustain their advantage or the management team makes critical mistakes, the company and stock price will likely suffer. The COVID pandemic brought on market conditions that made it incredibly difficult for any business to navigate through unscathed. Supply chain delays, labor shortages, inflationary pressures, geopolitical tensions, etc., significantly disrupted business plans and increased the probability of management mistakes. Coupling that with an overly sensitive investor base with a very short leash for bad news has amplified the severity of management misses. As a result, we are focused on increasing our diligence in assessing a company’s competitive advantage and management team under more extreme market duress.

There have also been several cases where we underestimated regulatory risks that were realized and either temporarily or permanently disrupted the growth trajectory of some of our portfolio companies. While we have always factored regulatory risks into a company’s quality assessment, the number of regulatory cases that have impacted one or more of our portfolio holdings over the past several years has been significantly elevated. This has forced us to increase the weight that regulatory risks have on our quality scores across sub industries and geographies.

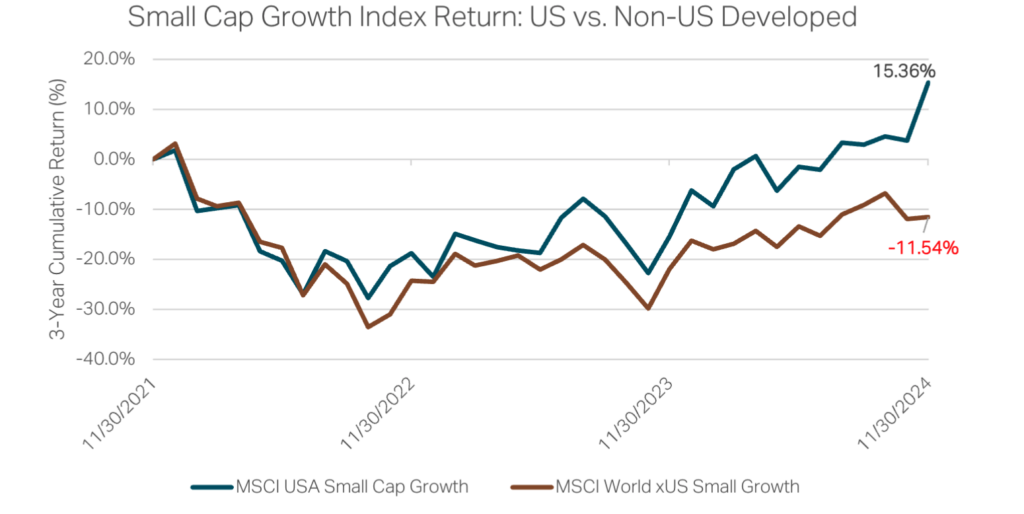

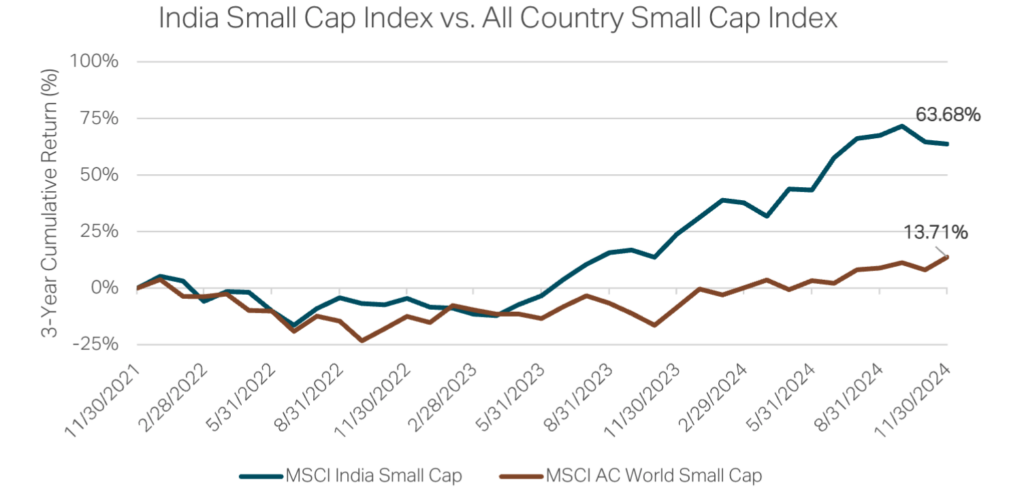

On the valuation front, our biggest mistake this year stemmed from not having enough exposure to markets that we felt were overpriced or too low in quality, but which have exhibited very favorable price momentum anyway. After 2022, when we underperformed due to holding onto too many stocks that had become overvalued during 2021’s market rally, we’ve shied away from investing in regions that we felt were too expensive. Instead, we focused on areas where our QVM dashboard indicated more favorable relative value. To our detriment, growth stocks in countries like the United States and India (see Exhibits 4 and 5), which had what we felt were frothy valuations, continued to rally and significantly outperform this year. While I believe our valuation-related mistakes will correct themselves in the long run, expressing too much valuation discipline has been a major hinderance to our 2024 performance.

Exhibit 4

Source: Factset, MSCI Index returns, Nov 30, 2021-Nov 30, 2024

Exhibit 5

Source: Factset, MSCI Index returns, Nov 30, 2021-Nov 30, 2024

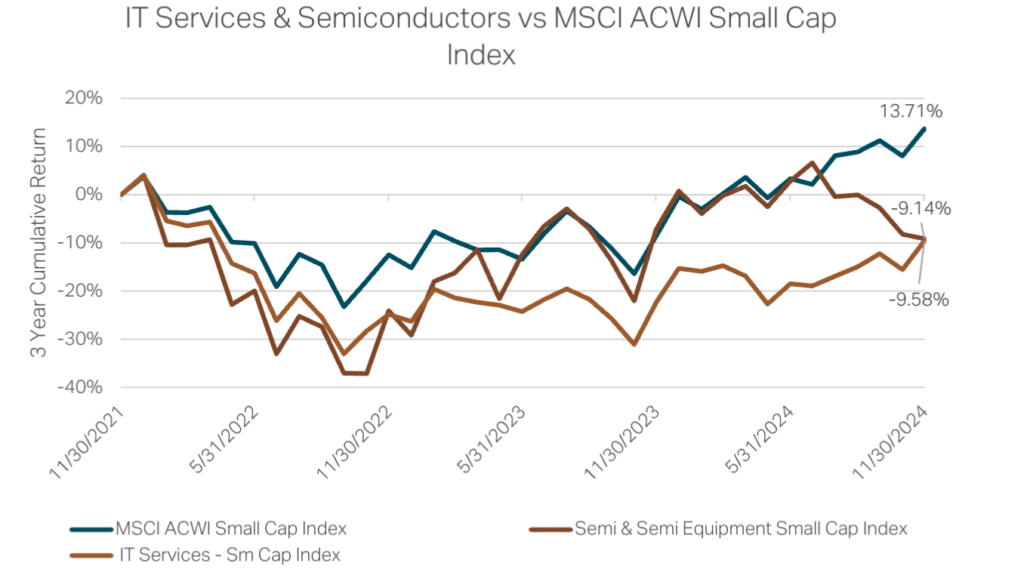

There have also been cases where we have gotten our weighting wrong. Throughout our history, we have typically been overweight the Information Technology sector. It is a sector that we know well and one that is constantly restocked with small, high-quality growth companies. Within the sector, we favor the “picks and shovels” tech companies that mediate the world’s digital transformation. As a result, we have invested heavily in companies that provide IT services or produce and design semiconductors (i.e., computer chips). Over the past three years, both sub-sectors have significantly lagged the overall market as investors have questioned the impact that Artificial Intelligence will have on their business models. This overweight has been one of the most significant reasons for our underperformance versus peers with our same growth-style bias (See Exhibit 6).

Our Semiconductor names, which had recovered reasonably well from their 2022 lows, have given back most of their gains and more over the past two quarters. Like toilet paper, far too many computer chips were purchased during Covid, and it caused a massive inventory overhang and semi-chip manufacturer business momentum to stall in 2023. In anticipation that semiconductor demand would pick back up this year, we increased our weighting. Unfortunately, the timing of our increase was premature, and the market has not responded well to a delayed recovery. We anticipate this source of underperformance will eventually turn in our favor. We believe these are great companies and we are starting to hear and see a lot of positive signs now in the IT Services and Semiconductor sectors that point to a light emerging at the end of the tunnel. While it never feels good when you get your investment timing wrong, we have very strong conviction in the quality of IT companies that we own and their long-term growth prospects.

Exhibit 6

Source: Factset, MSCI Index returns, Nov 30, 2021-Nov 30, 2024

Finally, there have been several cases where some of our big weight stocks have been subject to significant price declines despite delivering very stable earnings results. While these scenarios are frustrating and test our patience, we also see some benefit, given we were able to increase our ownership at a very attractive price.

In periods like this, we continue to remind ourselves that long-term price performance is driven by earnings growth. So, when market returns may not make fundamental sense, we know that we can look to our earnings growth to tell us if we are headed in the right direction. This is why we consider earnings growth as our north star. Our portfolio companies’ earnings growth has been much more resilient than our performance would suggest. While they haven’t realized as much growth as we projected given the slower than expected business momentum, the year-over-year growth has exceeded the earnings growth of the benchmark. In other words, we don’t have what we refer to as a “torpedo problem”. That’s when a company’s earnings are down significantly, and its business plan is permanently impaired. On the contrary, our companies have strong balance sheets, high free cash flows and low debt. And we expect that earnings growth to accelerate in 2025.

Meanwhile, our Global Contrarian Fund, which has a value bent and marginally lower quality standards than our growth-oriented funds, has been a top decile performer over the past five years. We believe this is objective evidence that the process employed by our research team still results in good stock selection and that most of the performance issues in our growth-oriented portfolio have been style, value, and weighting.

Looking forward, I have the utmost confidence that the lessons we have learned over the past three years and the process enhancements we have made will help us avoid many of the small-cap pitfalls.

When Robert, Eric, and I founded the firm in 2011, we observed foreign small cap markets that were rich with attractive investment opportunities and were largely ignored by other asset managers. We believed that approaching the investment opportunity with a global mindset and a QVM discipline would result in outstanding performance. After 13 years, I can assure you that none of that has changed.

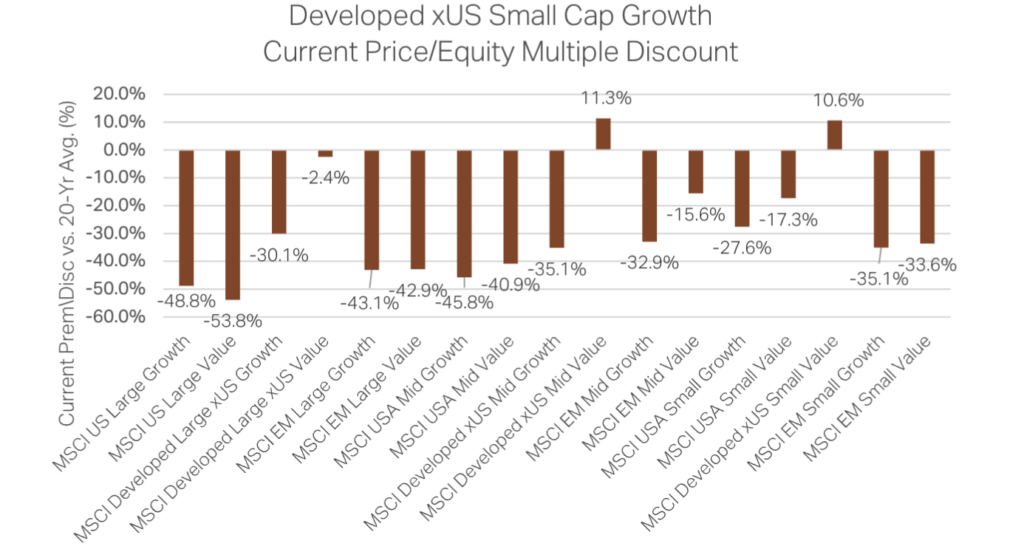

Today, global small cap markets offer incredible value relative to most other segments of the global equity market. Several segments of the small cap market are trading at lower valuations than they have at any point during this century. The chart below (See Exhibit 7) illustrates the current discount that foreign small cap growth stocks are trading at in price-earnings multiple terms relative to almost every other segment of the public equity market. For example, foreign small cap growth stocks are now trading at a 48.8% discount to US large cap growth stocks compared their 20-year average premium/discount. When relative valuations normalize, the prospective absolute and relative returns for foreign small cap growth stocks could be very attractive.

Exhibit 7

Source: FactSet, MSCI Index data as of Nov 30, 20243

Today, we are more excited about the underlying fundamental quality of our portfolios than we have been in a long time. We believe we have a tremendous amount of stored value in what we own relative to the benchmarks and our peers, and that our portfolios’ performance will recover as investor sentiment for small cap growth stocks improves and the business momentum of our companies picks up, which we expect in 2025. Furthermore, many of the headwinds that we have faced recently (e.g., US, large cap outperformance), are likely to turn into very favorable tailwinds. Until then, we know we must exercise patience and remain stalwart in our commitment to focus on what matters most in determining long-term results, earnings growth. We also know that without your extended vote of confidence and patience with us, we would not be able to invest the way we do, prioritizing long-term outcomes.

ANNOUNCEMENTS

While we could never expect to consistently outperform over short timeframes, we do feel like a three-year window is typically enough time to overcome spurious short-term headwinds. Unfortunately, our growth funds have failed to do so. You, our clients, have been remarkably patient, perhaps more so than we’ve deserved. As a demonstration of our gratitude and in acknowledgement that we haven’t lived up to our own expectations, we will be applying a modest fee waiver to our small- and mid-cap growth funds for the full 2025 calendar year. This will be a 10 basis point4 waiver on Global Opportunities (GPGOX/GPGIX), International Opportunities (GPIOX/GPIIX), Emerging Markets Opportunities (GPEOX/GPEIX), Global Reach (GPROX/GPRIX), and Global Explorer (GPGEX); and a 5 basis point wavier on Global Stalwarts (GGSYX/GGSOX), International Stalwarts (GISYX/GISOX), and US Stalwarts (GUSYX).

Additionally, we will be temporarily reopening all our soft-closed funds at the beginning of 2025. We look to reopen our funds for the benefit of investors when the market gives us a compelling investment opportunity and we have the capacity to take on additional assets. Clients may remember us doing so for a few months in early 2020 after the sharp market pullback brought on by the COVID pandemic. As you know, we are big believers in “eating our own cooking,” so Grandeur Peak will also be adding more of our balance sheet capital into our Funds at the time of reopening.

We look forward to founder, Robert Gardiner, returning to Grandeur full time in July 2025. Given the headwinds our investment style has faced during his absence, he’s excited to be back on the front lines. He plans to resume a leadership role on the Global Opportunities and International Opportunities strategies. He also plans to take an oversight role for Global Reach and Global Explorer strategies. These two strategies are the backbone of our firm’s structural advantage. Robert is passionate about working with these teams to continue to hone our competitive advantage as we come out of this tough period.

Thank you again for your trust. We welcome any further discussion or questions you may have.

Sincerely,

Blake

Blake Walker

CEO & Co-Founder

Grandeur Peak Global Advisors

An investor should consider investment objectives, risks, charges, and expenses carefully before investing. To obtain a Grandeur Peak Funds prospectus, containing this and other information, visit www.grandeurpeakglobal.com or call 1-855-377-PEAK (7325). Please read it carefully before investing.

The performance data quoted represents past performance. Current performance may be lower or higher than the data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call 1-855-377-PEAK (7325).

The Advisor may absorb certain Fund expenses, without which total return would have been lower. Net Expense Ratio reflect the expense waiver, if any, contractually agreed to through September 1, 2025. A 2% redemption fee will be deducted on fund shares held 60 days or less. Performance data does not reflect this redemption fee or taxes.

RISKS: Investing in small and micro-cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investments in emerging markets are subject to the same risks as other foreign securities and may be subject to greater risks than investments in foreign countries with more established economies and securities markets. Diversification does not eliminate the risk of experiencing investment loss.

The adviser’s judgments about the growth, value or potential appreciation of an investment may prove to be incorrect or fail to have the intended results, which could adversely impact the Fund’s performance and cause it to underperform relative to other funds with similar investment goals or relative to its benchmark, or not to achieve its investment goal.

Grandeur Peak Funds are distributed by Northern Lights Distributors, LLC Member FINRA/SIPC Northern Lights Distributors, LLC is not affiliated with Grandeur Peak Global Advisors, LLC or Foreside Financial Services, LLC.

©2024 Grandeur Peak Global Advisors, LLC.

[1] The MSCI USA Small Cap Growth Index is designed to measure the performance of small cap securities exhibiting overall growth characteristics in the US equity market; The MSCI USA Small Cap Value Index captures small cap securities exhibiting overall value style characteristics across the US equity markets; The MSCI World ex USA Growth Index captures large and mid-cap securities exhibiting overall growth characteristics across Developed Markets, excluding the United States; The MSCI World ex USA Value Index captures large and mid-cap securities exhibiting overall value style characteristics across Developed Markets, excluding the United States; The MSCI Emerging Markets Small Cap Growth Index captures small cap securities exhibiting overall growth style characteristics across 24 Emerging Markets countries; The MSCI Emerging Markets Small Cap Value Index captures small cap securities exhibiting overall value style characteristics across 24 Emerging Markets countries.

[2] The MSCI AC World ex USA Small Mid Index captures mid- and small-cap representation across 22 of 23 Developed Market countries (excluding the US) and 24 Emerging Markets countries.

[3] Price/Equity is valuation metric used to evaluate a company’s stock and is calculated by the ratio of Price to Earnings, or the price of a share of stock over the earnings per share.

[4] A basis point is 1/100th of a percent.