Company Touch Tracker

This quarter our team engaged with 364 companies across the world, putting our total company touches at 1,152 through Q3, with a good start to Q4 as well. We are on track to have most company touches in a year since 2016.

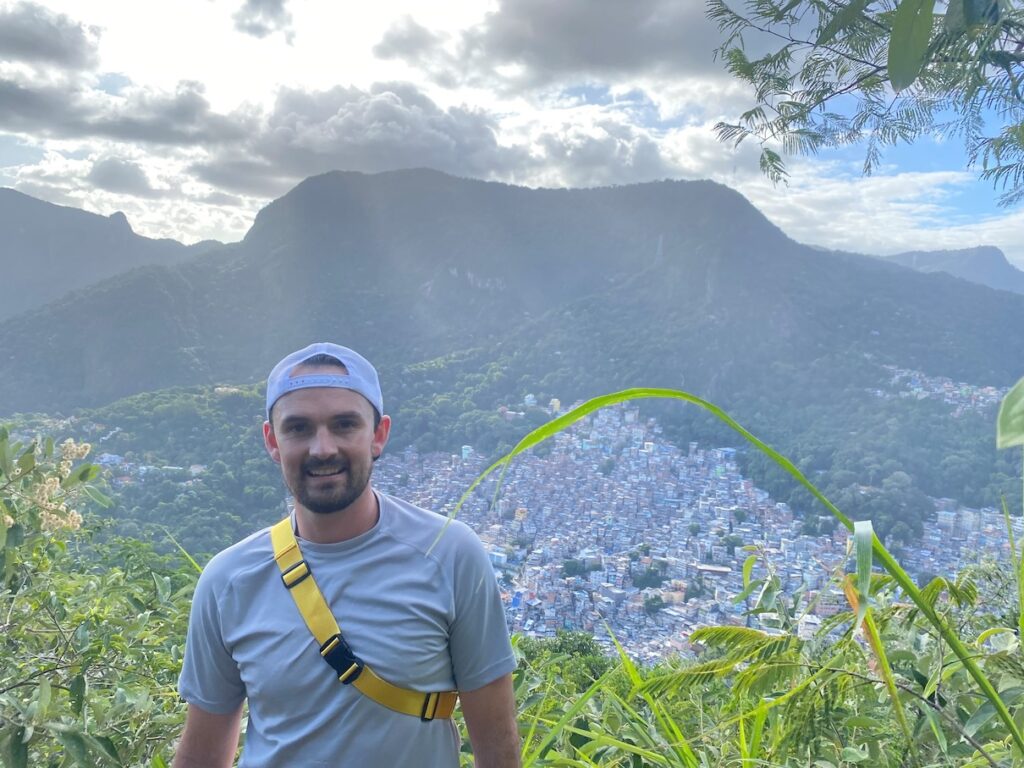

This past quarter, analyst teams traveled domestically to Boston, New York, San Francisco, Illinois, Missouri, and Southern California. Internationally, team members traveled to the United Kingdom, the Nordics, Hong Kong, Indonesia, Brazil, Italy, and Greece. Here are some findings from our visit to Brazil.

Brazil Recap

Mark Madsen, Portfolio Manager – Global Contrarian, Tyler Glauser, Portfolio Manager – Global Reach, Lead Analyst – Consumer, and Karson Schrader, Lead Analyst – Financials, met with 26 companies in Sau Paulo, Brazil. In addition to meeting with several companies on our Owned list, they also visited every Watch A company in the country. Our Watch A names are what we consider to be high-quality companies we would like to own but are currently too expensive.

Here are some key thoughts from Mark Madsen about the visit:

Tyler, Karson, and I took another trip to Brazil this quarter as the market has experienced several favorable macro trends recently.

Inflation has come down meaningfully to 5% after peaking out at 10.1% in 2021 and is expected to trend even lower in coming years. Also, the currency has been relatively stable and interest rates have come down from 13% to 9%. Many of the companies we met with were cautiously optimistic about the future.

The Brazilian equity market realized double digit declines in 2020 and 2021 but has bounced back in 2022 and YTD in 2023. So, while we see signs of positive price momentum, net returns are flat to slightly negative over the past four years.

Most companies we met with have business plans that are very dependent on the Brazilian economy for success. Few were focused on exports or expanding sales efforts outside of the country.

Of the companies we visited, those that scored the highest were mostly service-oriented (e.g., investment management, payment processing, internet, etc.). A third of our visits felt like easy passes as we left – where neither the numbers nor the stories felt very compelling. The remaining two-thirds had a fairly balanced list of pluses and minuses, and we committed to follow them more closely in case the QVM (Quality, Value, Momentum) profiles become more favorable.

It’s interesting to look at the differences and similarities between Brazil to India. Both countries have young populations and have had issues with corruption. Brazil is smaller geographically and GDP growth is slower, but it has more natural resources than India. Also, valuations on the ground level in Brazil seem much more reasonable than what we currently see in India.

In sum, we came back from the trip with heightened confidence in the companies we own in our portfolios and better understanding and appreciation for some of our Watch A names. While there are some great high-quality companies in Brazil that have real growth potential, Brazil continues to be a wildcard in our minds because of the challenge in assessing the currency risk. Will the Brazilian Real continue to be stable, or will it revert to being a volatile currency that has the potential to depreciate meaningfully and eat up solid investment returns? If the Brazilian government can maintain a stable currency for an extended period, it may eventually allow us to lower the currency risk premium we demand for investing in the Brazilian market and make the country a much more attractive area of our investment opportunity set.

Currency Risk – Currency risk, commonly referred to as exchange-rate risk, arises from the change in price of one currency in relation to another.

GDP – Gross Domestic Product (GDP) measures the monetary value of goods and services produced within a country’s borders in a given time period, usually a quarter or a year. Changes in output over time as measured by the GDP are the most comprehensive gauge of an economy’s health.

17634881-NLS-11/29/2023