Over the past fifteen years, many investors have pointed to U.S. equity performance as evidence of its perpetual dominance. This view highlights the concentration of large, innovative companies in the U.S. and its perceived economic resilience. However, emerging trends suggest a more nuanced outlook is warranted.

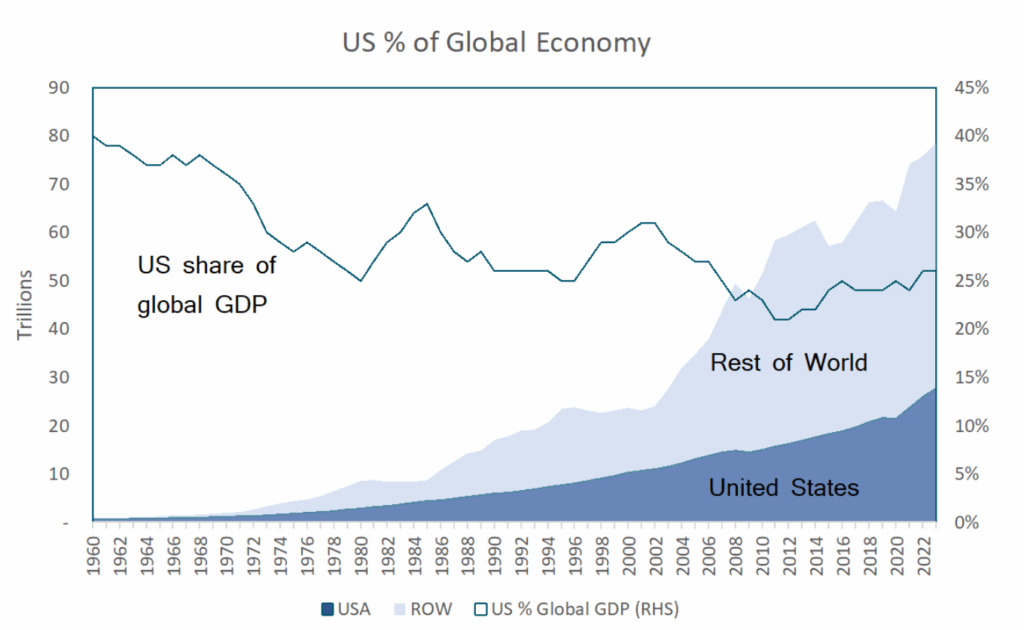

Shifting Economic Share

The U.S. share of global gross domestic product (GDP) has been gradually declining for decades, reflecting broader global economic shifts. Although still substantial, the economic weight of the U.S. is increasingly balanced by the rapid growth of other economies, particularly in Asia.

Source: Factset, May 2025

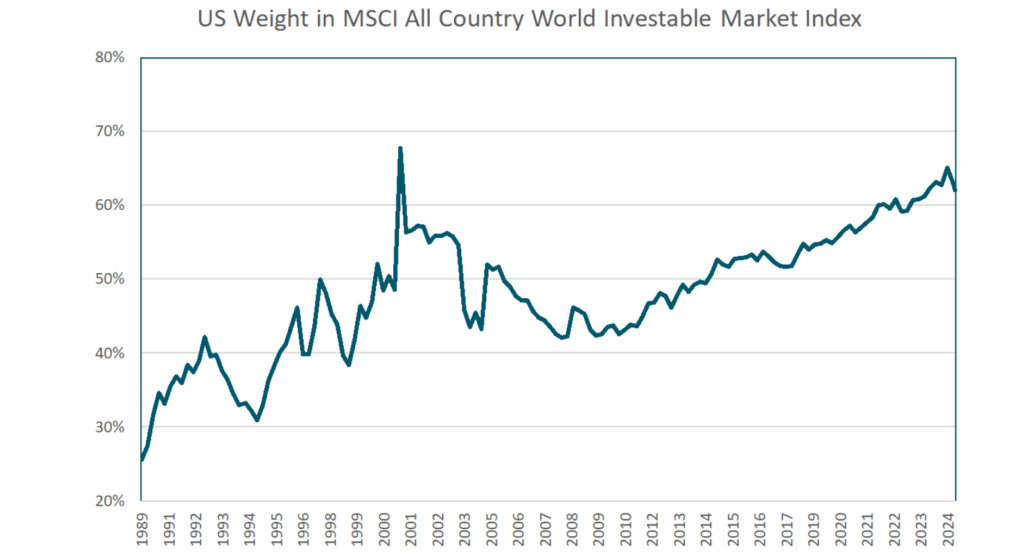

Despite this, the U.S. representation in global equity indices has increased significantly—an anomaly that reflects strong investor confidence in U.S. markets.

Source: Factset, May 2025

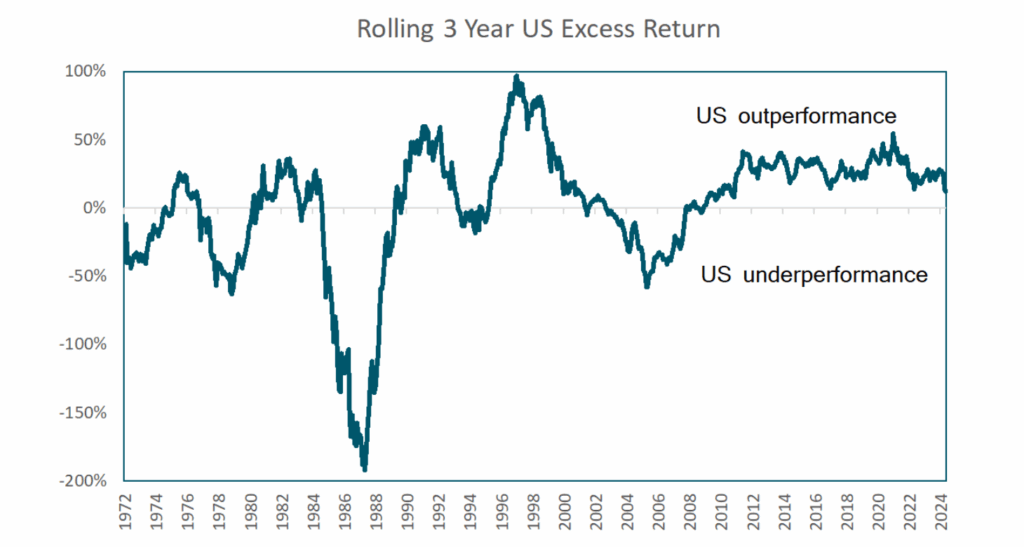

Cyclical Market Performance

Historically, U.S. equities have alternated between cycles of outperformance and underperformance relative to global peers.

Source: Factset, May 2025

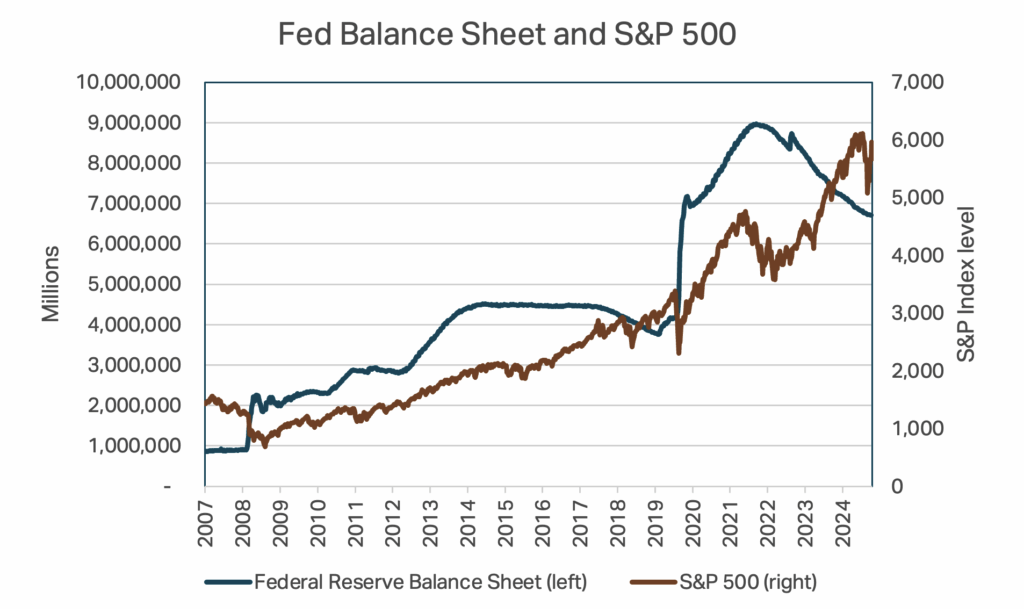

The past 15 years represent a notably extended cycle of U.S. outperformance, driven largely by unprecedented fiscal and monetary policy measures.

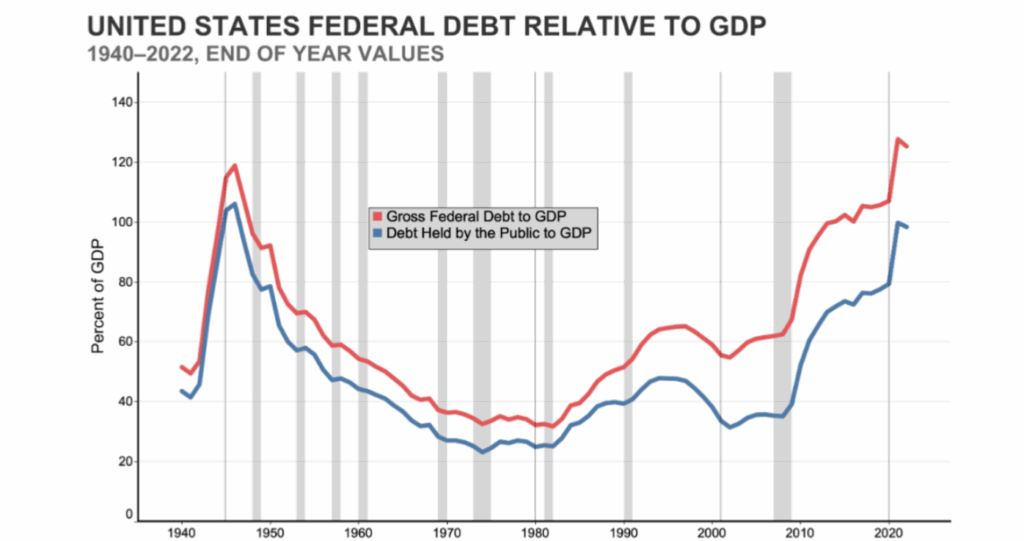

Since the onset of the Great Financial Crisis, the U.S. government’s gross debt to GDP ratio has increased from ~60% to over 120%

During the same period, the U.S. Federal Reserve’s balance sheet increased from less than $1 trillion to almost $9 trillion at its peak.

Source: Factset, May 2025

Debt and Dependency

The aggressive policy response has come at a cost. U.S. debt levels now rival those seen during World War II, casting doubt on the durability of debt-driven economic support. The ability of the U.S. to continue fueling growth without persistent government stimulus is increasingly uncertain. Should fiscal and monetary interventions diminish, the foundations of recent market strength may weaken.

Source: Urban Institute & Brookings Institution Tax Policy Center

Note: Shaded regions denote years in which there was a recession.

Implications for Investors

While the U.S. retains considerable influence in the global economy, its shrinking GDP share, prolonged equity outperformance, and rising debt burden introduce new risks. Investors should reassess the assumption of ongoing U.S. market superiority and remain alert to potential inflection points in global leadership and performance.

This post is for information and educational purposes only and expresses our opinion and view of the market and is not a recommendation to transact in any securities.