What does it mean to invest in quality? And why would anyone choose to invest in anything else?

As we define it, a high-quality company is one that exhibits increasing profitability, healthy cash flow, little-to-no debt, a top-notch management team, and a defensible business. Sounds great, right? We agree. When we find a company that checks all those boxes and is a reasonably priced stock, we have a candidate for our portfolios.

This is the company profile that our team has invested in for decades, and we expect to continue to invest in this manner for future decades.

But what happens when it doesn’t work?

At times, investors turn away from the high-quality traits we prize and instead favor more speculative opportunities. Recent examples include meme-stocks of Covid years, real-estate before the crash in 2008, and dot-com stocks in the late 90’s.

In recent years, we’ve seen significant underperformance in high-quality stocks in the international small-cap market, while the US small-cap market has not experienced this same dynamic.

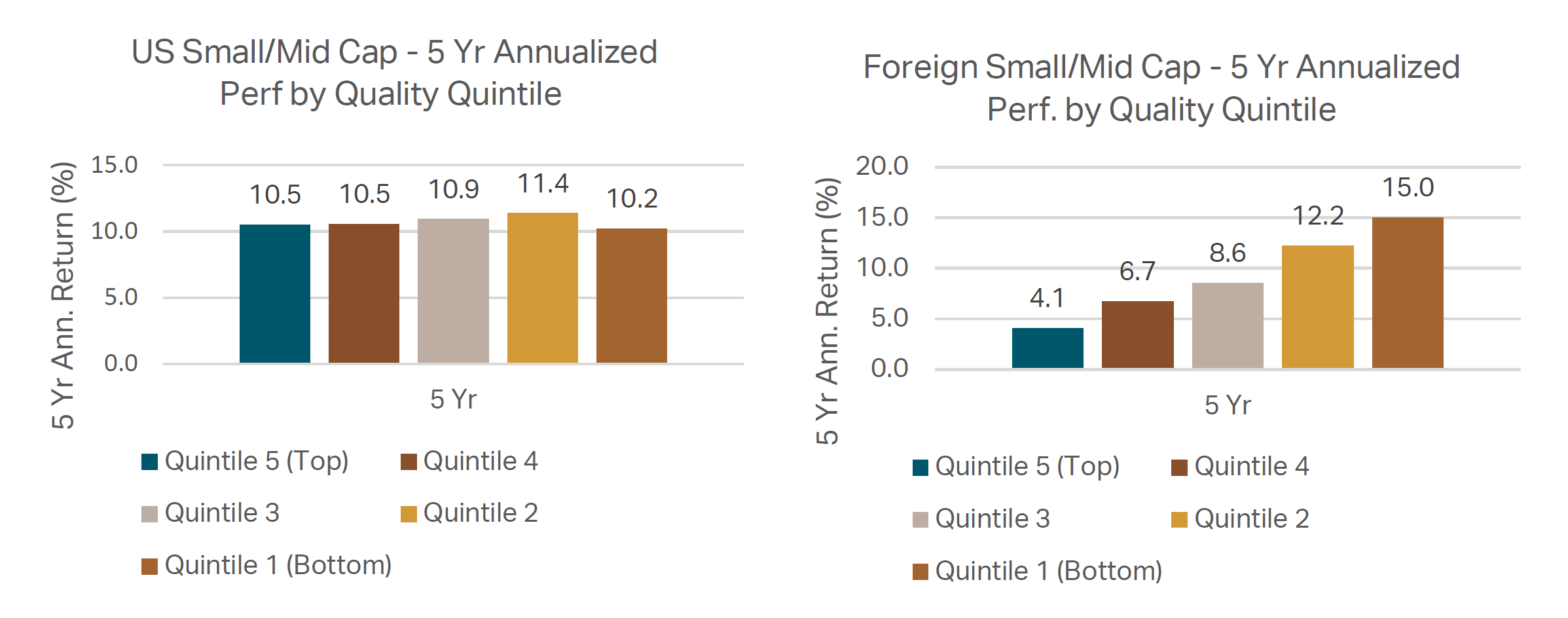

The following charts look at the five-year annualized performance of small- and mid-cap stocks in the US and abroad, using Morningstar’s universe of funds. We’ve split the funds into five groups using the Quality Factor assigned by Morningstar1.

The charts show that in US small- and mid-cap, performance across quality profiles was stable over the five-year period. Internationally, that was not the case. The data shows a large difference in performance, almost 11% per year, between the top and bottom quintile.

We believe this is a clear-cut example of a market that is not trading on business fundamentals but is being driven by more speculative factors. When we examine the companies in the lowest quality quintile, we see many examples of businesses related to bitcoin, precious metals, defense, quantum computing, and artificial intelligence. While some of these companies may have the attributes of a high-quality business at some point, they do not have them right now.

Periods like this test conviction. Owning speculative, low quality or poorly managed businesses runs counter to our responsibility as prudent stewards of your capital. Benjamin Graham, widely known as the father of value investing and frequently quoted by Warren Buffet, once said,

“In the short run, the market is a voting machine; in the long run, it is a weighing machine.”

Said differently, in the short run, sentiment, media narratives, and momentum can drive prices. Eventually, fundamentals reassert themselves, and the market weighs true value: earnings, cash flows, competitive advantages, and management quality. We will remain steadfast in our disciplined, quality-driven investment philosophy, confident that the international small-cap market will ultimately return to fundamentals and that we can capture both price appreciation and earnings growth when it happens.

This post is for information and educational purposes only and expresses our opinion and view of the market and is not a recommendation to transact in any securities.

1. The Morningstar Quality Factor describes the profitability and financial leverage of a company, based on an equally weighted mix of trailing 12-month return on equity and debt/capital ratios.